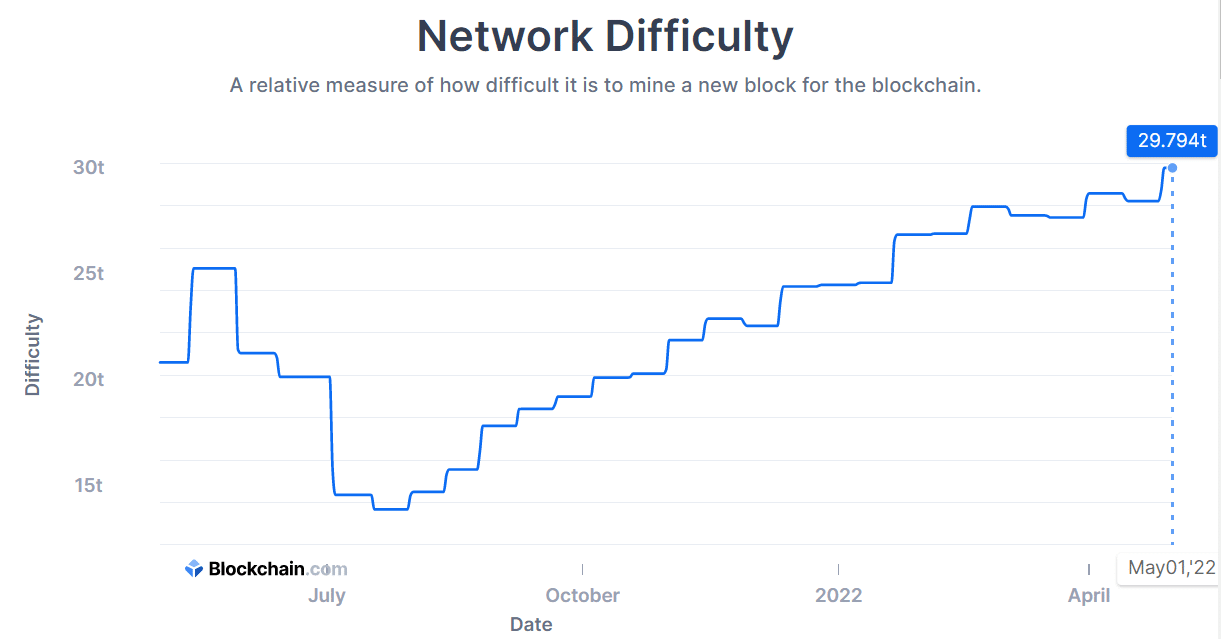

The Bitcoin network is arguably getting stronger as on-chain data suggests.

According to data from Blockchain.com, the Bitcoin network attained a new All-Time High (ATH) mining difficulty of 19.79T, a significant upshoot from the 13.673T recorded by the Bitcoin protocol when the difficulty slumped back in August last year.

-

Bitcoin total hash rate. Source: Blockchain.com

- The mining difficulty is a measure of the combined computational power that will be required to mine a block of Bitcoin. The higher the network difficulty, the more computational power required and vice-versa. The increased network difficulty is also a sign that the protocol is very much secured as the incidence of double spending and 51% attack is minimized by a great deal.

In contrast to the Bitcoin Network difficulty, the protocol saw a drop in the Total Hashrate which dipped below the 220 EH/s mark as of the 1st of May. The declining hashrate did not impact the mining difficulty by any significant margin.

However, the fundamentals behind the Bitcoin difficulty which is generally expected to stir investor’s interests seem absent over the weekend as the price of the cryptocurrency responded to a more negative review that came from Warren Buffett and Charlie Munger at the Berkshire Hathaway Inc (NYSE: BRK.A) Annual Shareholders Meeting held last Saturday. The two veterans condemned Bitcoin yet again, sending prices down to as low as $37,585.79 on Sunday.

The Bitcoin network has notably recorded a worse attack from regulators in the past. The slump recorded in the second half of last year was stirred by a ban in the Chinese mining ecosystem which pulled all miners away from the country. With the complete migration of the miners who took out residence in the United States, Kazakhstan, and Russia among others. Since stability returned to the ecosystem, the corresponding impact has been seen all around in the continuous uptrend of the Bitcoin network difficulty.

Network Difficulty and Growing Protocol Usability

The mining difficulty is a metric that showcases other good sides of the protocol as the Bitcoin network is becoming more usable as the average gas fee dipped to its All-Time Low (ATL) point of $1.039 on April 18. The ATL comes as a significant drop from the $62.788 that was recorded exactly about a year ago.

While there has continued to be whale accumulation in Bitcoin, several network data show the digital currency is also growing per its popularity amongst small-scaled retail investors. As miners jostled to get a share of the remaining 2 million minable BTC left, more computers will be plugged into the network which will, in turn, stir an adjustment in the protocol’s difficulty level which is billed to continue growing into the foreseeable future.

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.