On-chain data shows the Bitcoin whales have been back in accumulation mode recently, a sign that may be bullish for the cryptocurrency’s price.

Bitcoin Whales Have Bought 20,000 BTC In The Last Two Days

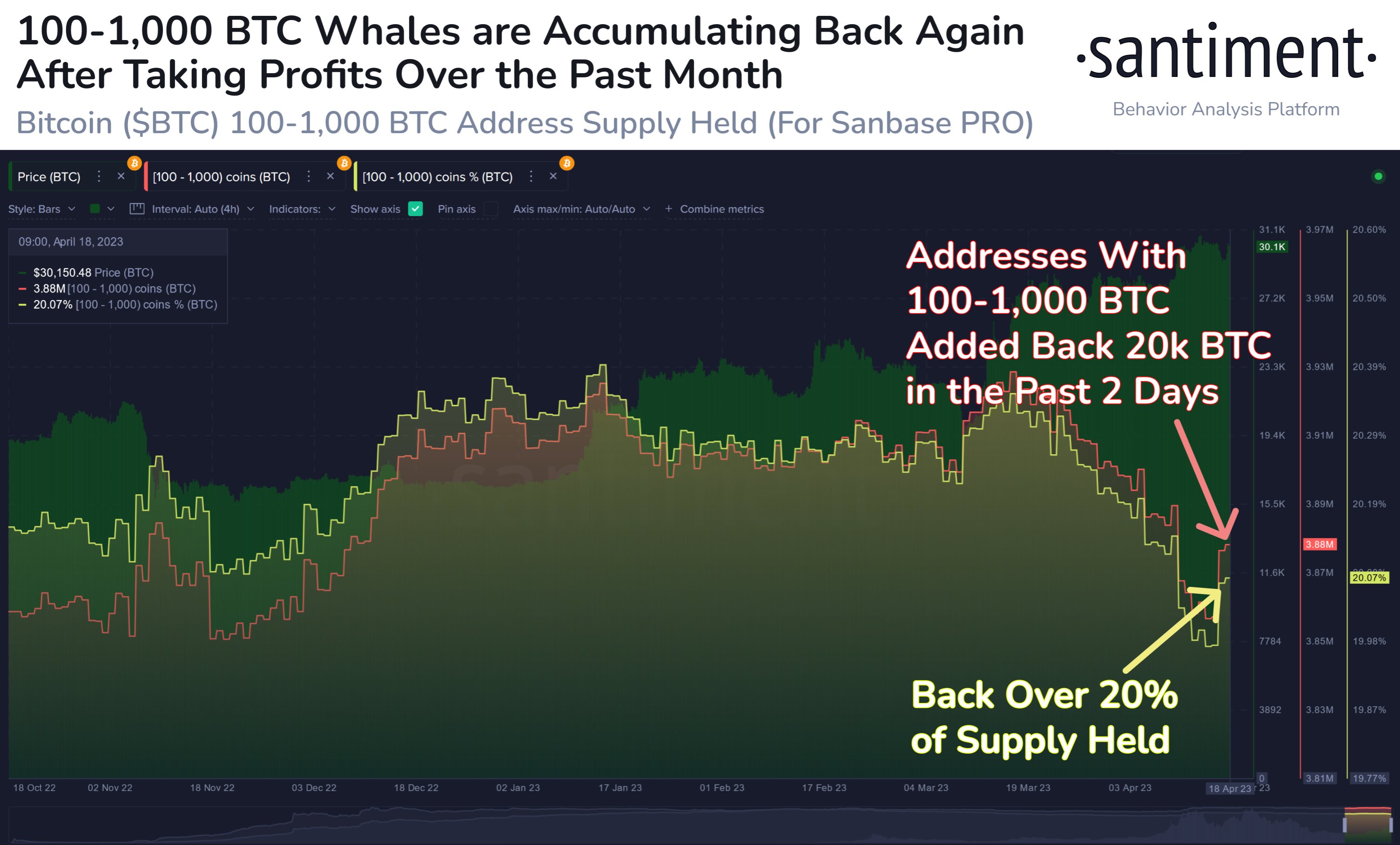

According to data from the on-chain analytics firm Santiment, the whales’ month-long dump seems to be over. The relevant indicator here is the “BTC Supply Distribution,” which tells us about the amount and percentage of the total Bitcoin circulating supply that is currently being held by each wallet group in the sector.

Wallets are divided into these wallet groups based on the total number of coins that they are carrying in their balances right now. For example, the 1-10 coins cohort includes all addresses that are holding between 1 and 10 BTC.

If the Supply Distribution metric is applied to this specific group, it will sum up the amounts being held by all wallets on the blockchain that satisfy this condition and calculate what part of the total supply this sum makes up.

Now, in the context of the current discussion, the segment of interest is the 100-1,000 coins group. The below chart shows the trend in the Bitcoin Supply Distribution for this particular cohort.

The value of the metric seems to have been rising in recent days | Source: CryptoQuant

As the range of this wallet group includes very large amounts ($2.92 million at the lower bound, $292 million at the upper one), the likely holders of addresses falling into this cohort would be the whales.

Whales are an important part of the Bitcoin ecosystem due to the large amount of supply that they own. Due to them holding a significant portion of the supply, they are able to cause noticeable effects on the price through their movements.

From the above graph, it’s visible that the BTC Supply Distribution of these humongous investors started to go down in the middle of March, implying that the whales were selling their coins.

While this selloff was taking place, the price of the cryptocurrency stopped its surge and hit a plateau around the $28,000 level. Recently, however, the dumping from these holders has stopped as the asset’s price has seen some additional rise.

In the past couple of days, the Supply Distribution of the Bitcoin whales has even reversed its trajectory, as these investors have now added around 20,000 BTC ($585.3 million) to their combined wallets.

With this latest accumulation from the whales, their total holdings have now hit a value of about 3.88 million BTC ($113.4 billion), which is around 20.07% of the entire circulating BTC supply.

As is clear from the chart, this value is still notably lesser than what the Bitcoin whales were carrying before the selloff in March began. Nonetheless, it’s still some positive recovery in their reserves.

Accumulation from these humongous holders can be a sign that they hold a bullish conviction about the cryptocurrency right now, which is naturally something that can be constructive for the market in the long term.

BTC Price

At the time of writing, Bitcoin is trading around $29,300, down 2% in the last week.

Looks like the value of the asset has taken a plunge during the past day | Source: BTCUSD on TradingView

Featured image from Todd Cravens on Unsplash.com, charts from TradingView.com, CryptoQuant.com