Since the beginning of the year, the meme crypto asset has surged from $0.0055 to over $0.40 in 2021, or a 72x return year-to-date.

More recently, following its listing on Coinbase and backed by several Musk’s tweets, the meme cryptocurrency gained more than 32% over the past 48 hours. By using IntoTheBlock’s indicators, we’ll dive into data to paint a clearer picture of the recent price action.

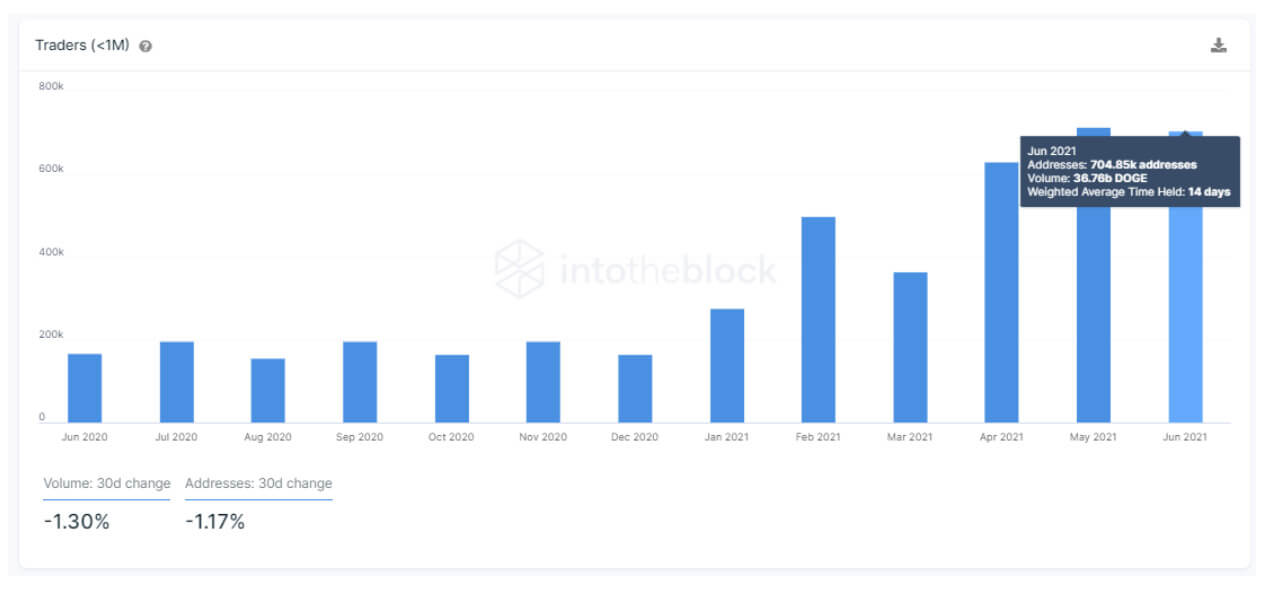

Dogecoin has been widely known for its speculative activity, which can also be noticed on-chain. The number of addresses holding DOGE for under a month— classified by IntoTheBlock as traders — is also almost back to its highest level, reached in May of this year.

The graph above shows that approximately 18% of the Dogecoin in circulation is being held by traders’ addresses, meaning that a sizable amount of the total supply changed hands within the last 30 days.

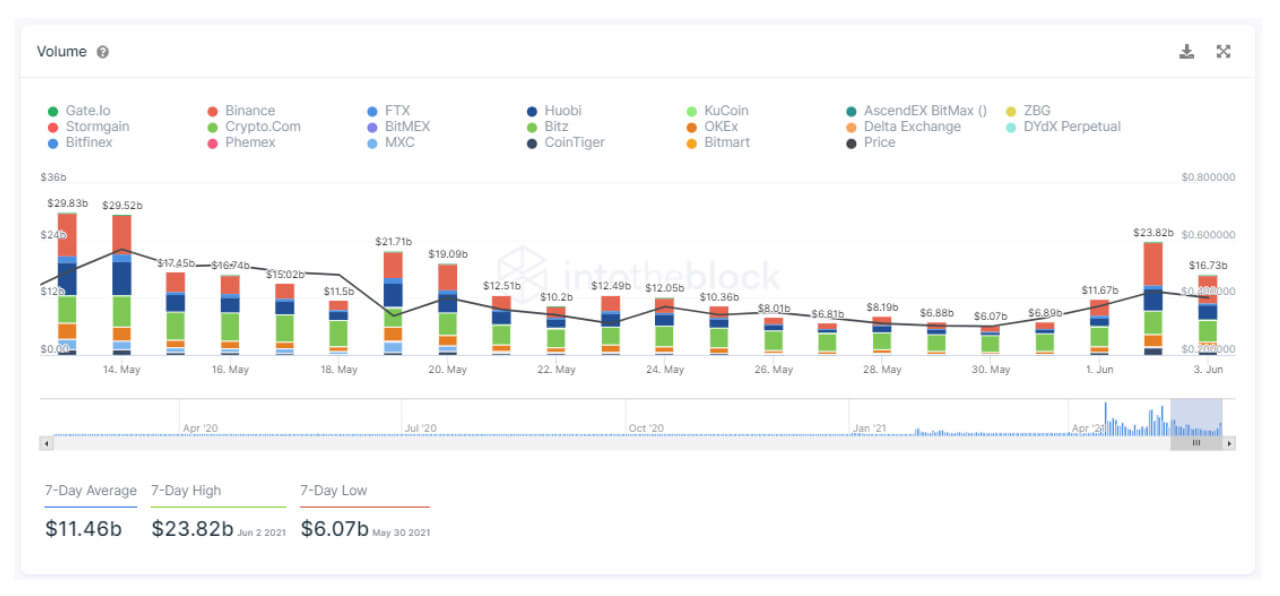

And as Coinbase confirmed in his blog post that they will start to accept inbound transfers of DOGE to Coinbase Pro, the derivatives market immediately reflected the positive news, as the volume of DOGE’s perpetual swaps increased by a staggering 104% in just a few hours.

As is the case with spot markets, derivatives volume can act as a sign of trend strength of the price movement. Following the Coinbase announcement, Dogecoin’s Perpetual Swaps Volume broke the $20 billion barrier again, reaching levels not seen since May 14.

While the market still remains uncertain, trading sideways for the past few weeks, positive news and buying activity are surrounding the leading meme coin. Is still early to determine if the worst is over, but on-chain and derivatives indicators are painting a bullish sign once again.

Guest post by Daniel Ferraro from IntoTheBlock

IntoTheBlock is an intelligence company that uses machine learning and statistical modeling to deliver actionable intelligence for crypto assets.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context