Half a billion dollars worth of Ethereum (ETH)—the world’s second-largest cryptocurrency after Bitcoin by market cap—have now been ‘burned’ after last month’s Ethereum Improvement Proposal (EIP)-1559, data from multiple sources show.

The EIP-1559, an upgrade designed to improve pricing mechanisms by including a fixed-per-block network fee that is burned, went live last month and has performed as expected so far.

Burn the Ethereum

As per data from onchain tracker Etherchain, over 177076.1 ETH has been burned in under four weeks since EIP-1559 went live. This amounts to over $675 million at current prices at press time, accounting for less than 1% of Ethereum’s 117 million circulating supply.

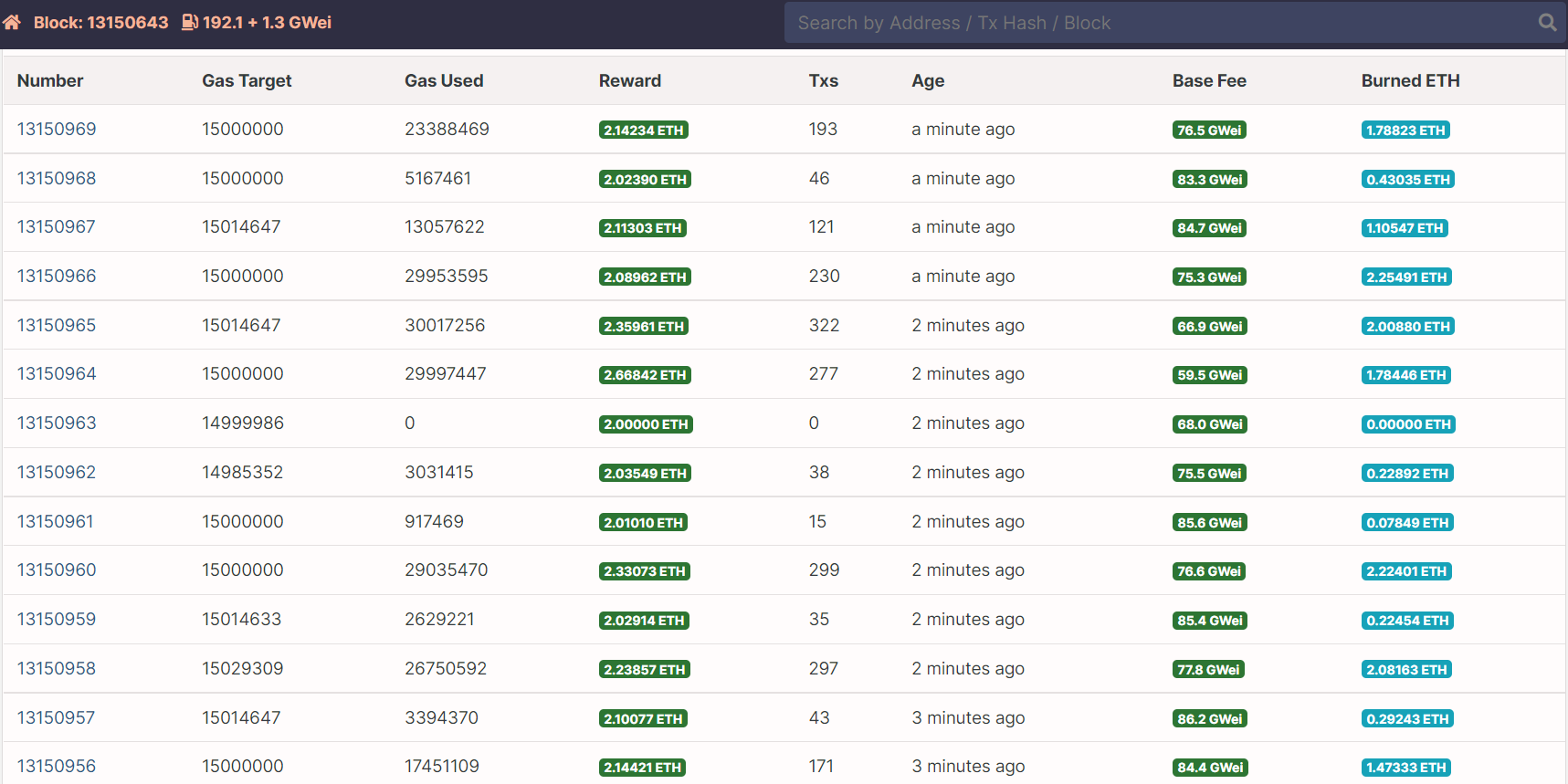

Between 5 ETH- 7 ETH are burned every minute ($21,000 to $27,000), with a block utilization of 50.9%. A snapshot of the past few blocks, per the below image, shows an average of 1 ETH is burned each block. Miners, on the other hand, earn over 2 ETH ($7,800) on average for each block they mine.

How EIP-1559 helps

The EIP-1559 makes fees more predictable for users. After the upgrade yesterday, a ‘base transaction fee’ is now charged to users, and it is algorithmically determined by how busy the network is. Users, on their end, ‘tip’ miners to have their own transactions processed quicker.

The miners themselves will only receive the tips, and the ‘base fee’ amount will be ‘burned’ out of supply forever. In terms of the market effect, this means there’s now fewer and fewer ETH supply available on the market daily, making the asset even more valuable to holders and investors, at least in theory.

And the market seems to be lapping up that narrative: Ethereum has risen over 50% in the past month and 21% in the past week alone, running to a $445 billion marketcap as of today. Some crypto traders are betting on a price target of as high as $10,000 per ETH this year—a marketcap of over a trillion dollars if that were to happen.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Like what you see? Subscribe for updates.