Based on his historical prediction of 2015 and 2019, PlanB remains confident that the Bitcoin price could rally to $500K during the mega bull run of 2025.

After a strong start to the year 2024 last week, Bitcoin has been facing some selling pressure but has managed to hold above $43,500 levels. However, this hasn’t stopped Bitcoin analysts from making bullish predictions for the crypto. PlanB, the author of the stock-to-flow model recently made a bold prediction for Bitcoin after the Bitcoin halving. Along with the spot Bitcoin ETF approval, the Bitcoin halving could be another major catalyst to propel the BTC price to new highs.

PlanB, a prominent figure in the cryptocurrency space, recently shared reflections on the trajectory of Bitcoin (BTC) and public sentiment over the years. Recalling the year 2015 when the purchase of the first BTC was made at $400, PlanB highlighted that during that time, many dismissed Bitcoin as a dying asset.

Fast forward to 2019, when BTC reached $4,000, PlanB authored the Stock-to-Flow (S2F) article, boldly predicting a future value of $55,000 for Bitcoin. Despite the skepticism faced at that time, PlanB’s forecast proved accurate as BTC soared to new heights.

In the current landscape with BTC priced at $40,000, PlanB emphasizes the significance of the Stock-to-Flow model, projecting a staggering $532,000 valuation after the 2024 halving event. Popular crypto analyst Michael van de Poppe stated that the target doesn’t look impossible considering institutional money flowing into BTC.

Where’s Bitcoin Price Heading Next?

We are just two days away from the approval of the spot Bitcoin and Bitcoin bulls are maintaining a strong watch. As per a report from Bloomberg, the US Securities and Exchange Commission (SEC) will conduct a vote on the 19b-4 forms within the next few days. The applicants for the Exchange-Traded Fund (ETF) are likely to submit Form S-1 by 8 am on Monday, January 8, 2024.

Earlier analyses by Bloomberg indicated that the likelihood of the ETF rejection decreased to 5%, considering recent meetings between SEC officials and representatives from firms seeking approval. The report noted, “If the SEC grants both sets of required approvals, the ETFs could commence trading as early as the next business day.”

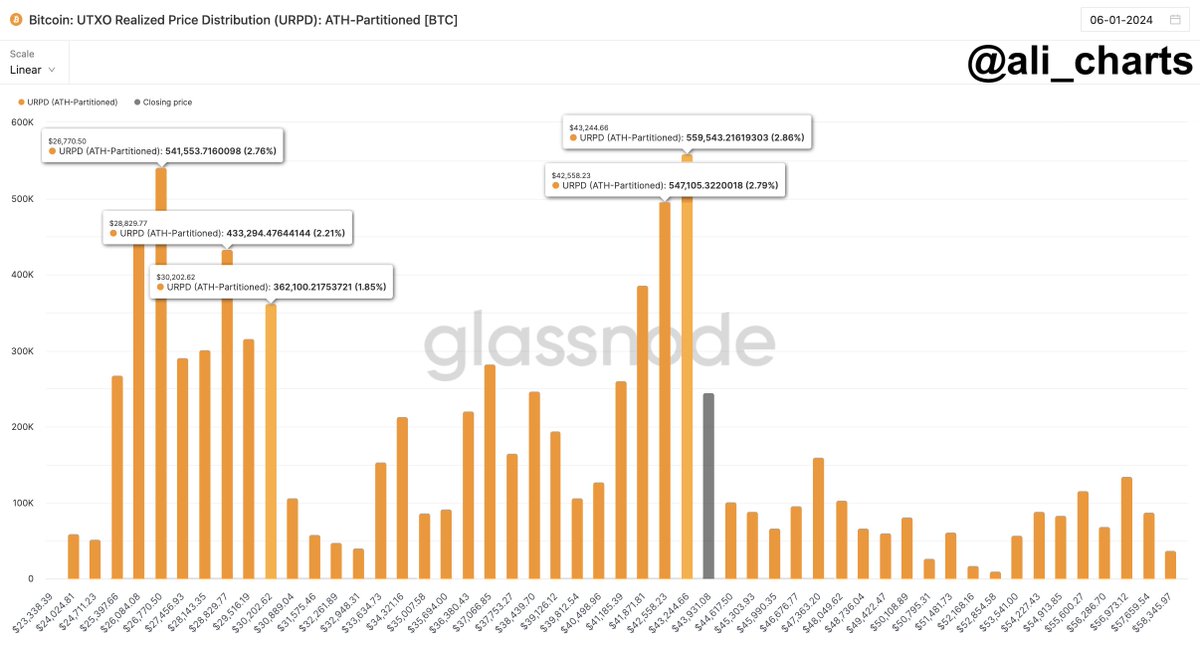

Cryptocurrency analyst Ali Martinez has observed a substantial support wall in the Bitcoin (BTC) market, with approximately 1.11 million BTC purchased in the price range of $42,560 to $43,245. Notably, the buyers have not sold their BTC, establishing a robust foundation for the digital asset.

Martinez suggests that if Bitcoin manages to maintain its position above this support level, the upward movement remains intact with limited resistance. However, a failure to hold the range between $42,560 and $43,245 could potentially lead to a downward trend, with the next critical area of interest lying between $26,770 and $30,220.

-

Photo: Ali charts

- Amidst the escalating ETF excitement, Milkybull Crypto, a well-regarded analyst in the crypto space, anticipates significant impacts on the price of Bitcoin (BTC). According to their projections, the fervor surrounding ETFs could propel BTC to $80,000 in 2024 and a staggering $200,000 by 2025. Additionally, Milkybull Crypto posits that these developments might also bring positive effects for Ethereum (ETH) and various other altcoins in the market.